What current volatility means for selling a business and how we should be advising our clients.

Program produced by XPX Atlanta.

Taxes, War, Elections, Inflation, $5+ Gas, Supply Issues, The Great Resignation – what is investor appetite like in these volatile times and likely to be over the next few years? For our July XPX program, we’re assembling an expert panel to discuss the current and near-term impacts and provide advice for having this conversation with our clients.

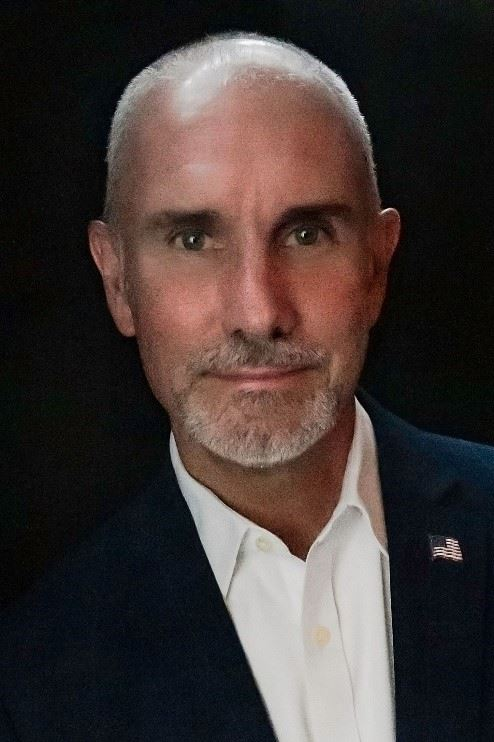

MODERATOR

David Shavzin

President

The Value Track

David is an M&A advisor who draws on a unique combination of skills and experience in mergers, acquisitions, joint ventures, exit strategy, and value growth. He started out in 2000 to help business owners maximize their life’s work. The focus of The Value Track is to gain an in-depth understanding of the seller’s situation and needs, work The Value Track process and watch as a large wire arrives in our client’s bank account. David is President & Co-Founder of XPX Atlanta and is a frequent speaker on these topics. David’s early career includes 12 years with global life sciences company Sanofi/Aventis in finance, M&A, and operational roles.

PANELISTS:

John Marsh

Managing Partner

Bristol Group

John is a successful cross-functional executive with experience leading and strengthening finance, accounting, and operations organizations. He has held a variety of executive roles including CFO, VP of Supply Chain and Planning, and EVP of Finance and Operations during his 17-year career. In those roles, John served as an integral part of the leadership team that scaled a medical device company and sold it to a private equity firm for $161M. John led integration efforts and was a part of due diligence on all of the company’s acquisitions.

John started his career with the accounting firm, Ernst and Young in Atlanta, GA, and has worked with both start-ups and a large private equity-owned medical device manufacturer. He leverages his significant mergers and acquisition experience to help entrepreneurs successfully transition business ownership. John graduated from the University of Georgia with a BBA in Accounting and holds an MBA from Kennesaw State University. He currently lives in Marietta, with his wife and two daughters.

Bob Tankesley, MBA, CPA

Principal

Neri Capital Partners

Bob is a 4th generation entrepreneur, MBA and CPA with a keen understanding of the business owner mindset. As an M&A advisor, he uses his 26 years of experience to sell companies grossing up to $50M in revenue throughout the southeast U.S., as well as the commercial real estate associated with such holdings. When a company is not ready to sell, Bob regularly partners with advisors of all types to optimize companies throughout the ownership lifecycle. He is Vice President and Co-Founder of the Exit Planning Exchange Atlanta and is a frequent speaker to owners and their advisors in different professional settings.

Tim Templeton

Director

Trivest Partners

Tim has been sourcing investment opportunities to Trivest Partners for more than 20 years. Trivest is the oldest private equity firm in the Southeast (1981 – Miami), and exclusively partners with family and founder owned businesses. By reviewing more than 4,000 deals annually, Trivest is averaging 50 acquisitions per year, making them among the most active PE firms in the lower middle market. Trivest currently has 41 companies in its portfolio across the United States and Canada.