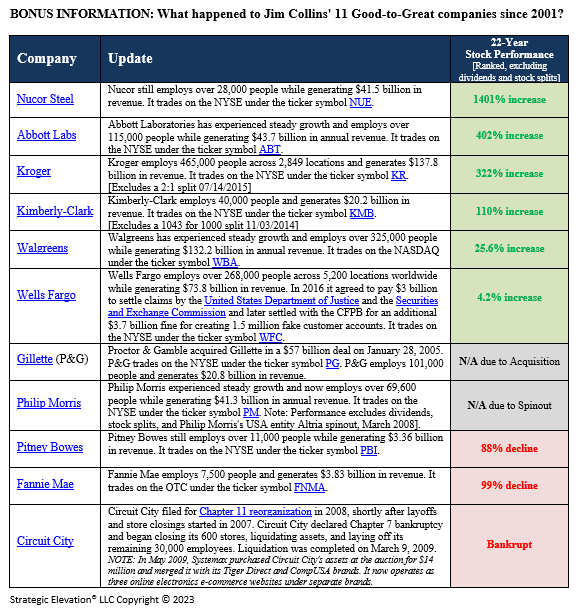

Whatever happened to the original 11 companies Jim Collins featured in his 2001 book Good to Great?

As part of a review I recently published of Collins’ original book, I uncovered a few unexpected surprises that have occurred since. Spoiler Alert: One dropped 88%, another dropped 99%, and a third declared bankruptcy.

Book Overview. Good to Great was a game-changer when it came out in 2001. Years earlier, Collins had dinner with Bill Meehan, the Managing Director of McKinsey’s San Francisco office. Meehan challenged Collins’ conventional thinking by opining that most great companies were already great and came from solid lineages like David Packard and George Merck. Meehan suggested that the next tier of so-called good companies might never achieve greatness because it’s much easier to settle for just being good. Being great is hard. The vast majority of companies were good companies and may never experience greatness. Collins set out on a journey to find the answer to the question, “Can a good company become a great company, and if so, how?”

Scope. Collins launched a five-year research project involving 20 MBA students at Stanford University to analyze and compare a group of 28 companies’ performance over time. Their analysis identified 11 companies that had gone from good to great. This group had beaten the general stock market by an average of 7x in 15 years, which more than doubled the results delivered by a composite index of what was considered the gold standard of businesses at the time of Intel, GE, Merck, and Coca-Cola.

Structure. The book is organized into nine chapters and an Epilogue full of FAQs. Each chapter features a carefully crafted summary at the end that highlights the key points and takeaways encountered during that section. Collins organizes his research into the following concepts: (1) Good is the Enemy of Great, (2) Level 5 Leadership, (3) First Who, Then What, (4) Confront the Brutal Facts, (5) The Hedgehog Concept, (6) The Culture of Discipline, (7) Technology Accelerators, (8) The Flywheel and the Doom Loop, and (9) From Good to Great to Built to Last.

Research Methodology.

11 Featured Companies. Collins’ team established technical search criteria to identify a group of companies from the Fortune 500 from 1965-1995 that consistently outperformed their peers and the overall market over a sustained (15-year) period. This group of featured companies included: Abbott Labs, Circuit City, Fannie Mae, Gillette, Kimberly-Clark, Kroger, Nucor Steel, Philip Morris, Pitney Bowes, Walgreens, and Wells Fargo.

17 Direct Comparison Companies. His team then established search criteria to identify a group of Direct Comparison companies (same industries) that occasionally outperformed their peers and the overall market. The group that made this list included: Upjohn, Silo, Great Western, Warner-Lambert, Scotts Paper, A&P, Bethlehem Steel, RJ Renolds, Addressograph, Eckerd, and Bank of America. They also included six Unsustained Comparison (short-term) companies, including Burroughs, Chrysler, Harris, Hasbro, Rubbermaid, and Teledyne, resulting in a combined list of 17 direct competitors.

Systematic Qualitative and Quantitative analyses. After thousands of articles, interviews, transcripts, financial reviews, and research on these 28 companies, the team was able to compare the good against the great to identify critical patterns and behaviors that the great companies did (or didn’t do) versus the good companies to position themselves for sustained excellent performance.

Key Findings. The research team discovered many lessons along the way, but one “giant conclusion” stood above the others. Their research confirmed that “almost any organization can substantially improve its stature and performance, perhaps even become great, if it conscientiously applies the framework of ideas they [the Collins team] uncovered.” Additional lessons learned from the companies that went from good to great:

-

Celebrity Leaders. Famous leaders with larger-than-life personalities who ride in from the outside were negatively correlated with taking a company from good to great.

-

Executive Compensation. There is no systematic pattern linking specific forms of executive compensation to the process of going from good to great.

-

Strategy. The strategic planning process did not separate the good-to-great companies from the comparison companies. Both sets of companies had well-defined strategic plans, used similar planning processes, and spent comparable amounts of time on long-range strategic planning.

-

What Not To Do. Good-to-great companies focused less on what to do, than on what not to do, and what to stop doing.

-

Technology. Technology-driven change has virtually nothing to do with igniting a transition from good to great. Technology can only accelerate a transformation but cannot cause a transformation.

-

M&A. M&A plays virtually no role in igniting a transition from good to great. Merging two mediocre companies never make one great company.

-

Focus on the business. Good-to-great companies create alignment and motivation by focusing on running their business rather than getting distracted by large-scale change management initiatives.

-

No Launch Event or Revolutionary Process. Good-to-great companies had no name, tagline, or launch event to signify the start of their transformation. Most were evolutionary, not revolutionary.

-

Greatness is primarily a matter of conscious choice. Good-to-great companies were not, by and large, in great industries; some were in terrible industries. Greatness is not a function of circumstance (i.e., sitting on the nose cone of a rocketship).

What I Found Interesting. Few people realize that as unfortunate as Collin’s only high-profile bankruptcy was of his original 11 Good To Great companies, a rise-from-the-ashes story emerged shortly before the Circuit City bankruptcy happened. The Circuit City management team accelerated the spinoff of another one of their start-ups, called CarMax (NYSE: KMX), which has since grown into a juggernaut that today employs 32,647 people and generates $31.9 billion in annual revenue.

It’s interesting to note that even when the original Circuit City business model was failing to keep pace with their larger rival, BestBuy, their leadership team had the foresight and was able to fund and launch the next great idea – while continuing to build both businesses for a few years until they were able to safely step off the sinking Circuit City ship and onto the CarMax lifeboat they had launched.

Summary – The book organizes a highly complex, multi-year research project into groups of insightful examples using a framework that supports and explains their findings. The case studies were well-researched and easy to follow, and I appreciated the handy summaries at the end of every chapter. I was impressed with the breadth and depth of the research put forth to write the book. Based on years of empirical research, data gathering, interviews, and real-world examples, it provides an understandable path for helping companies move from good to great.